does indiana have a inheritance tax

He lived in Kentucky at the time of his death. 1 2013 this form may need to be completed.

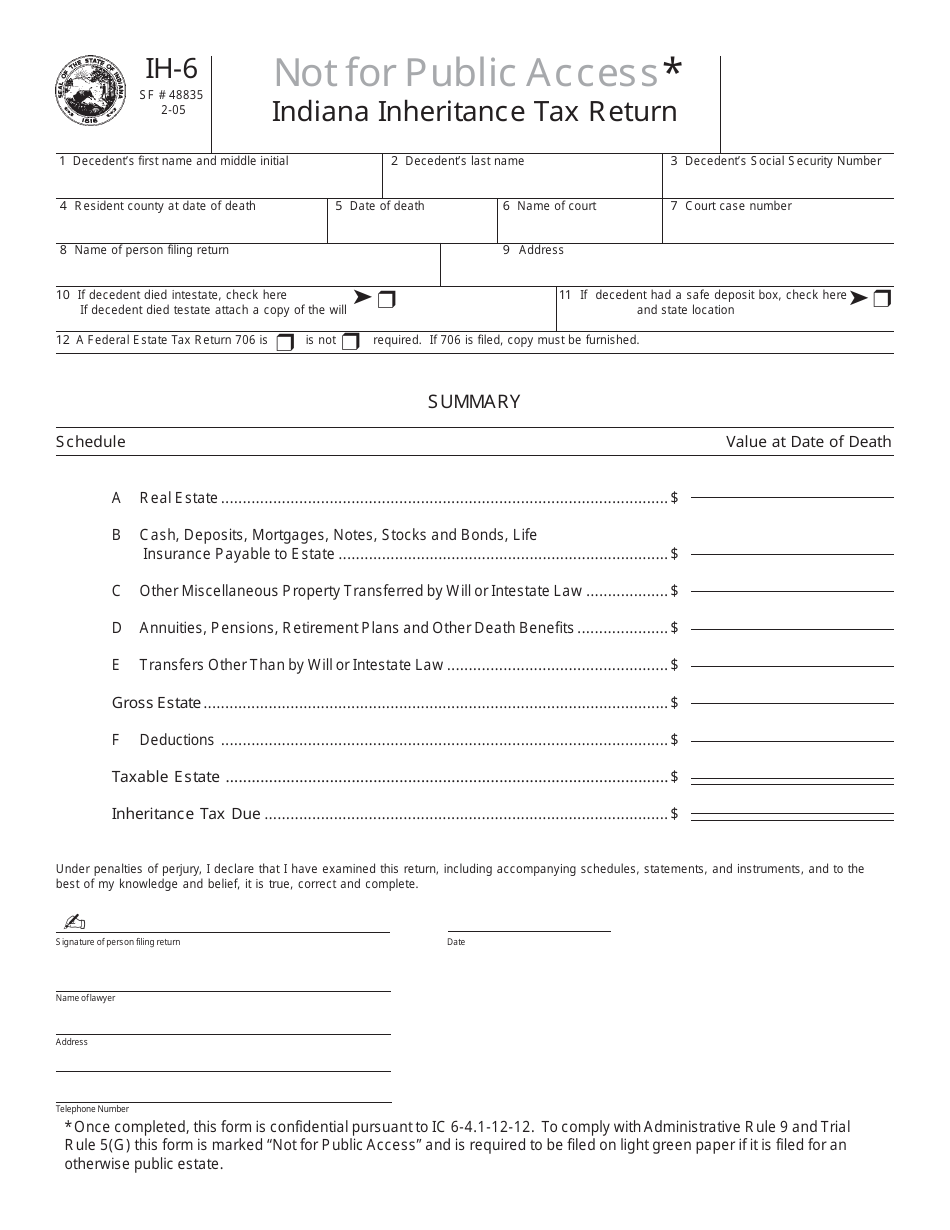

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

. Repeal of Inheritance Tax PL. For those individuals dying before Jan. Any income from your inheritance will be taxed in the US according to US rules.

For deaths occurring in 2013 or later you do not need to worry about Indiana inheritance tax at all. Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance. Indiana repealed the inheritance tax in 2013.

Inheritance tax rates also depend on the amount inherited. Lets say you live in Californiawhich does not have an inheritance taxand you inherit from your uncles estate. In 2013 Indiana sped up the repeal of its inheritance tax retroactively to January 1 2013.

For more information please join us for an upcoming FREE seminar. For individuals dying after December 31 2012. At this point there are only six states that impose state-level inheritance taxes.

One example of this is in Iowa where an inheritance with a value of 25000 or less isnt taxable. There is no federal inheritance tax and only six states have a state-level tax. Transferring Inheritance Money To The US.

They can help you understand estate or inheritance taxes and your obligation to pay the tax and fill out. Some states allow for monetary exemptions. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

This includes both an attorney acting as executor and a personal representative named in the will or approved by the court. 205 2013 Indianas inheritance tax was repealed. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

On the federal level there is no inheritance tax. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. COVID-19 Update on Inheritance Tax Returns. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

However youll still have to report your inheritance to the IRS by filing Form 3520 along with your annual tax return. Use of Affidavit of No Inheritance Tax Due This form does not need to be completed for those individuals dying after Dec. The Indiana Probate Code allows for the executor to be paid according to IC 29-1-10-13.

Does Indiana require a inheritance waiver. Does Missouri require an inheritance tax waiver. Sandra would be responsible for paying the tax.

Indiana does not have an inheritance tax nor does it have a gift tax. As of 2020 only six states impose an inheritance tax. The tax rate varies depending on the relationship of the heir to the decedent.

Want this question answered. There are 12 states that have an estate tax. It may be used to state that no inheritance tax is due as.

You would owe Kentucky a tax on your inheritance because Kentucky is one of the six states that collect a state inheritance tax. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance tax you should seek the counsel of an estate attorney. Indiana Inheritance and Gift Tax.

States have typically thought of these taxes as a way to increase their revenues. However be sure you remember to file the following. There is no inheritance tax in Indiana either.

As mentioned inheritance tax rates vary from state to state. How the Inheritance Tax Works. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. Contact an Indianapolis Estate Planning Attorney.

How much is inheritance tax in Indiana. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012. However other states inheritance laws may apply to you if.

However it doesnt require them to accept payment. The following is a description of how the tax worked for deaths that occurred prior to 2013. No tax has to be paid.

New Jersey Nebraska Iowa Kentucky and Pennsylvania. Does Indiana have inheritance tax 2021. Just five states apply an inheritance tax.

So the net effect was that high income and high asset people were moving to other states does. This tax ended on December 31 2012. In the many years that I have served on the Indiana State Bar Association Probate Trust Real Property Section Council the ISBA Probate Review Committee and the Probate Code Study Commission for the Indiana Legislature there have been numerous bills presented in the legislature to repeal the Indiana Inheritance Tax.

Federal estatetrust income tax. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec.

However many states realize that citizens can avoid these taxes by simply moving to another state. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed and no tax has to be paid. This form is prescribed under Ind.

Does Indiana Have an Inheritance Tax or Estate Tax. Indiana used to impose an inheritance tax. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. You only have to pay US inheritance tax if the deceased was a US resident citizen or green card holder. In addition no Consents to Transfer Form IH-.

How Much Tax Will You Pay in Indiana On 60000. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. Does Louisiana Have an Inheritance Tax.

Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. Spouses are automatically exempt from inheritance taxes.

That means that if your husband or wife passes away and leaves you a condo you wont have to pay an inheritance tax at all even if the property is located in one of the states. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Indiana Estate Tax Everything You Need To Know Smartasset

Complete Guide To Probate In Indiana

What Should I Do With My Inheritance Inside Indiana Business

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

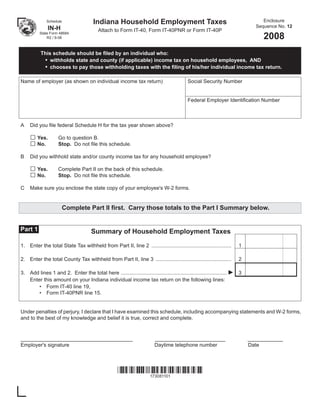

Indiana Household Employment Taxes

Free North Carolina Last Will And Testament Templates Pdf Docx Formswift Will And Testament Last Will And Testament Personal Financial Statement

Everything To Know About Probate In Indiana In 2021 Webster Garino Llc

Indiana Moneywise Matters Indiana Moneywise Matters Wills Trusts And Estate Planning Basics

Indiana Estate Tax Everything You Need To Know Smartasset

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

What Happens If You Die Without A Will In Indiana

Indiana County Assessors Association Serving Our Counties With Pride

Complete Guide To Probate In Indiana

Avoid These 15 States In Retirement If You Want To Keep Your Money Retirement New England States States

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller